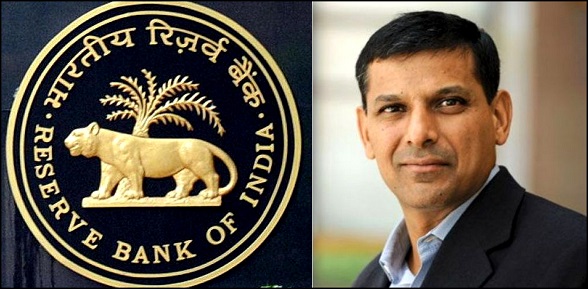

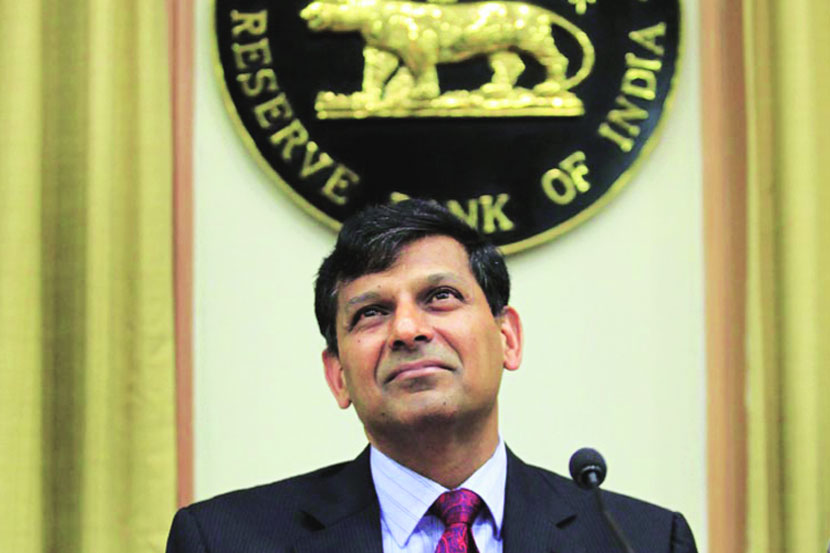

Raghuram Rajan is the 23rd Governor of RBI, the central bank in India. He assumed charges on September 4, 2013. During his stint of almost 3 years, there are some commendable highlights of his contribution in the financial system that is hard to look by.

Here are his top 5 achievements as the RBI Governor – a financial master who is willing to take challenges head on, following facts and numbers about his work is certainly a hard look away.

1. Inflation

Rajan is known for his primary focus on curbing inflation. His biggest achievement is that he successfully brought down retail inflation to 3.78% in July 2015 from 9.8% in September 2013 – the lowest since the 1990’s.

2. Consumer Price Index (CPI)

Under Rajan, the RBI adopted consumer price index (CPI) as the key indicator of inflation, which is the global norm, despite the government recommending otherwise.

3. Strengthen Forex Reserve

India’s Forex Reserve is now stronger by about 30% than it was two years back. During the recent depreciation, Rajan said the central bank has Forex Reserves to the tune of $380 billion, which is a comfortable level, and would intervene if there was a need.

4. New Bank Licenses

Under Rajan, two universal banks have been licensed and eleven payment banks have been given the nod. This is expected to extend banking services to the nearly two-thirds of the population who are still deprived of banking facilities.

5. Futuristic

Rajan has made an immense contribution to the field of economics, the greatest being his prediction of the economic turmoil in the US and Europe during 2008-2012. The prediction cemented his position among some of the greatest economists of our times.

Most of his reforms and policies are being praised highly. However, Rajan has been criticized on interest rates and inflation issues. He is known for his forward and practical approach as an instrument in battling the inflation which plagued the nation when he was designated the role of RBI Governor.