Announced and confirmed, it is Brexit. The referendum declares Britain’s exit from the 20 member European Union. It will certainly ripple the global economy and markets, may be in just a blink of an eye. But the question now lingers, will Brexit impact India? If yes, will be on the negative grounds, or positive?

In an article in The Wall Street Journal , Grer IP termed the possible exit of the UK from EU as “the starkest repudiation yet of the postwar consensus favoring ever – deeper global integration”

“A further unraveling would undermine global growth prospects already clouded by aging populations and miserable productivity,” he said in the article.

Indeed, Brexit will have a deep impact on the global economy and in turn on India –

1. The Relationship Of Trade, Export And Import Between India And UK

In the last five years, the trade has been more or less stable. The figures of India – UK Bilateral trade are considerably going on a much settled note. Since the two-way trade between India and the UK has been fairly stable, the impact is likeyly to be minimal in this area.

In an article, Biswajit Dhar, a professor of economics at the Jawaharlal Nehru University (JNU) stated “Britain’s exit from the EU probably won’t have any significant impact on this”

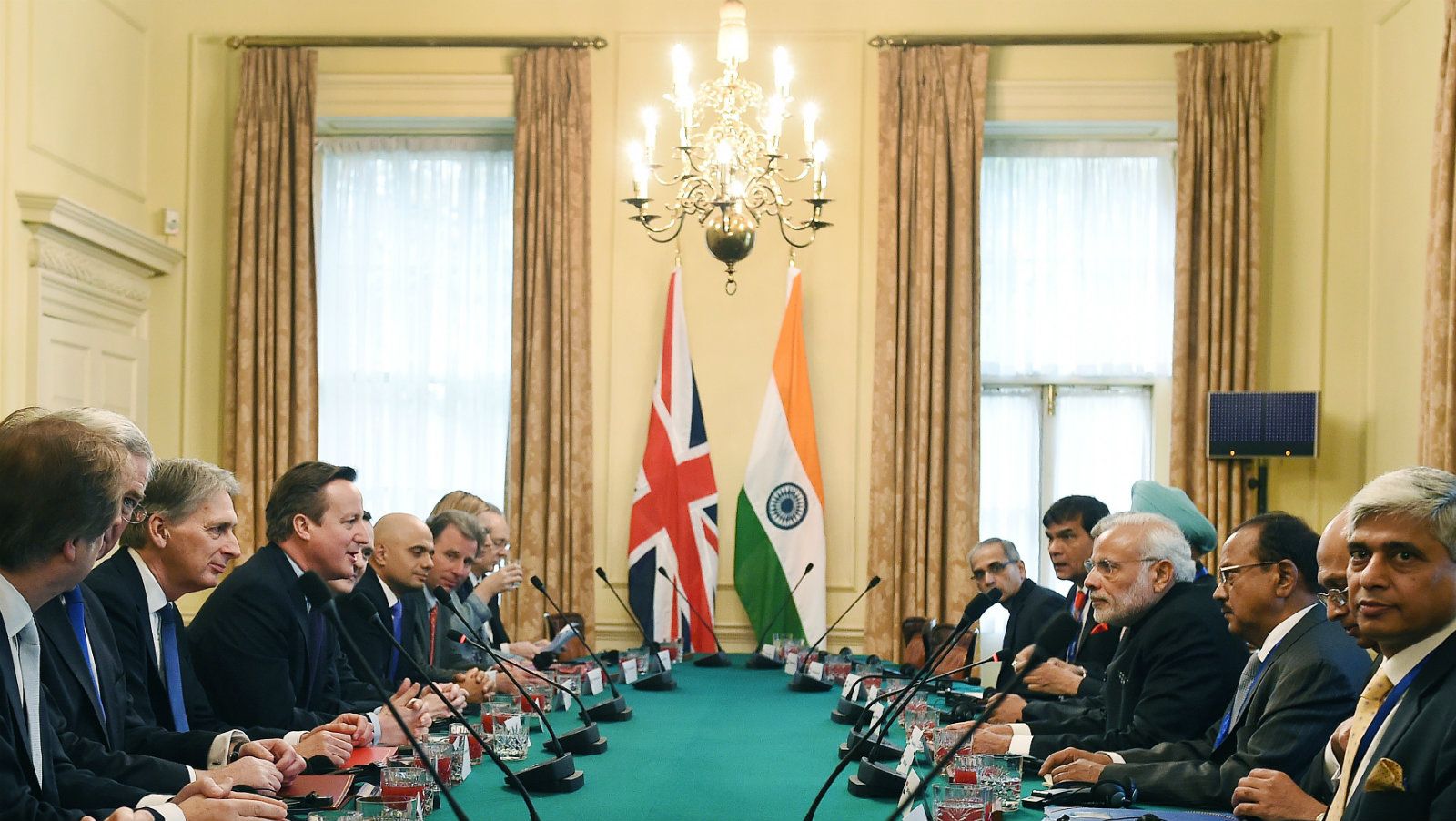

2. India Is One Of The Largest Source Of FDI To The UK

India invests the maximum in UK than in any other country. According to Deloitte, as stated in an article, “There are an estimated 800 Indian owned businesses in the UK, including companies like Tata Motors (Jaguar Land Rover – UK Company) with more than 110,000 employees. Further, the UK is also India’s largest G20 investor,” it said.

FDI getting effected by Brexit is an inevitable impact on India.

3. What About The Companies And Profits

UK is the maximum revenue generator source for Indian companies. Maximum of Indian businesses choose to establish their European offices in the UK, to gain the flexible working operations in the UK and to avail the benefits of staying in Europe. Removing this gateway would be problematic for Indian businesses in the UK, who may choose to relocate and direct investment someplace else.

Nasscom recently in an article said a Brexit will have a negative impact on the $108 billion Indian IT sector in the short term. However, it said the exact nature and extent of the impact will emerge over a longer period of two years or more.

4. Status On Currency And Markets

Wait for the snowball effect on India, as UK and the US takes the major hit back with currency downfall. This might be due to foreign investors winning over their losses by sell-offs in emerging markets, including India. Global market volatility will be certainly expected, the pound will depreciate against major economizes. Hence, India cannot escape from this, Sensex and Nifty will tumble in the short-run.

“For India, it would be more of a reaction to global news, which does not affect it directly to a large extent, except possibly some of the corporates which have large exposure to UK. Post the knee-jerk reaction, we may again get on track due to benign domestic factors,” said Ambareesh Baliga, an independent equity markets analyst.

5. All About The Commonwealth, Travel And Workforce

Britain will always need a continuous inflow of talented workforce, and India has been generating the needs due to its English-speaking population. Migration from European boundaries will be drying up, Britain would will certainly reach out for migration from other countries, which will suit India’s interests.

The UK is one of the most popular destinations for Indian tourists going to Europe. Further, Britain is one of the most important destinations for Indians who want to study abroad. With Brexit, the universities will free up funds and scholarships for students from other countries, just not limited to EU.